Scroll to:

Directions of decarbonization of Russian ferrous metallurgy

https://doi.org/10.17073/0368-0797-2025-1-90-97

Abstract

Ferrous metallurgy is a colossal industry with a huge number of industrial facilities and equipment built for centuries. It accounts for approximately 8 % of current global anthropogenic emissions of CO2 oxides. The future of decarbonization of these assets depends on investments by major market players in the development and implementation of breakthrough steel production technologies and operation of the carbon units market. With careful and responsible management of companies’ climate agenda, even against the backdrop of ever-growing demand for steel, metallurgy has every chance of reducing greenhouse gas emissions by 2.5 times in 25 years. At the same time, the implementation of industrial and environmental innovations at enterprises requires an integrated approach. As part of the research, we studied the regulatory documents of the Government of the Russian Federation regulating reduction of carbon intensity of products, growth of energy conservation and reduction of the impact on climate of the metallurgical industry. Criteria for sustainable (including green) development projects for steel producers were identified. The analysis of EVRAZ Group’s climate initiatives, carried out as part of the implementation of the company’s decarbonization strategy, was conducted. The identified climatic projects of the Russian industrialists were developed with the aim of producing and selling coal units. The formulated key directions of decarbonization of domestic ferrous metallurgy include operational methods for reducing direct and indirect greenhouse gas emissions, transition to environmentally friendly technologies, the use of low-carbon energy sources, introduction of closed crude cycles of ferrous metals, and optimization of the total carbon intensity of the asset portfolio. The implementation of environmental and climate projects will ensure the sustainable development of the metallurgical industry, optimize integrated efficiency indicators, and identify a niche in the competitive business environment.

Keywords

For citations:

Chernikova O.P., Afanas’eva O.V., Afanas’ev E.G. Directions of decarbonization of Russian ferrous metallurgy. Izvestiya. Ferrous Metallurgy. 2025;68(1):90-97. https://doi.org/10.17073/0368-0797-2025-1-90-97

Introduction

The global metallurgical industry is a consolidated sector that produces semi-finished products for other areas of the economy, operates with a high level of material processing, and requires extremely high temperatures to sustain technological processes [1 – 3]. It is a large-scale socio-technical system, employing over six million people directly and generating an additional 40 million indirect jobs throughout the supply chain [4]. The industry’s global revenue is estimated at approximately $2.5 trillion, accounting for 3 % of the world’s GDP [5]. Due to the increasing returns to scale in production, the majority of pig iron and steel output is concentrated among a few major players (countries) [6 ‒ 8].

According to the 2023 World Steel Association rankings, Russia ranked among the top five steel-producing nations, with an output of 76 million tons (4 % of global production, totaling 1,888 million tons). Russia was surpassed by China (54 %, 1,019 million tons), India (7 %, 140 million tons), Japan (5 %, 87 million tons), and the United States (4 %, 81 million tons)1. Approximately 40 % of Russia’s ferrous metallurgy output was exported, primarily as semi-finished products intended for further processing into sheet metal, rolled products, and other materials.

The challenge of climate change is driving global efforts toward carbon neutrality and industrial decarbonization. Given its energy- and carbon-intensive nature, the ferrous metallurgy sector has become a focal point for researchers in various countries, including China [9; 10], Japan [11], the United Kingdom [12; 13], Thailand [14], Sweden [15; 16], Russia [17 – 20], Ukraine [21], South Korea [22], and others.

At the end of 2022, the Russian government approved the Strategy for the Development of the Metallurgical Industry of the Russian Federation until 2030. The strategy outlines a transition toward decarbonization through the advancement of low-carbon technologies, modernization of production facilities, and government support for the development and implementation of breakthrough technologies [23].

Ferrous metallurgy primarily supplies industrial consumers, including machine building, metalworking, сconstruction, and railway transport. Consequently, decarbonization of the metallurgical sector holds significant potential for reducing indirect emissions across other industries [24].

Research materials and methods

The study is based on a general scientific methodology, employing methods of scientific abstraction, dialectical development, abstract logic, comparative analysis, and synthesis of information obtained from various recent domestic and international publications.

Research results and discussion

Over the past four years, Russia has adopted a series of regulatory documents aimed at reducing the carbon intensity of production, increasing energy efficiency, and mitigating climate impact. These include the Strategy for the Socio-Economic Development of the Russian Federation with Low Greenhouse Gas Emissions until 2050; the federal law On Conducting an Experiment to Limit Greenhouse Gas Emissions in Certain Regions of the Russian Federation; Government Decree No. 455 of March 24, 2022, On the Approval of the Rules for Verifying the Results of Climate Projects; Government Decree No. 449 of March 24, 2022, On the Approval of the Rules for Assessing the Achievement of Target Indicators for Reducing Greenhouse Gas Emissions; and others.

On March 11, 2023, the Government of the Russian Federation issued Decree No. 373, amending Decree No. 1587 of September 21, 2021. This amendment established criteria for sustainable (including green) development projects for steel producers, including:

– compliance with the lower threshold of specific greenhouse gas emissions for various metallurgical production stages, in accordance with the Best Available Techniques reference guide;

– reduction of actual pollutant emissions and discharges by 10 % or more;

– improvement in resource and energy efficiency by at least 10 %;

– implementation of a closed water circulation system without industrial wastewater discharge;

– production of carbon steel and high-alloy steel;

– adoption of advanced technologies;

– utilization of carbon capture and storage (CCS) technologies.

In response to the growing emphasis on carbon reduction, EVRAZ Group has developed a decarbonization strategy spanning 2020 to 2060. The strategy is structured into three phases: short-term (until 2027), medium-term (2030 – 2045), and long-term (until 2060).

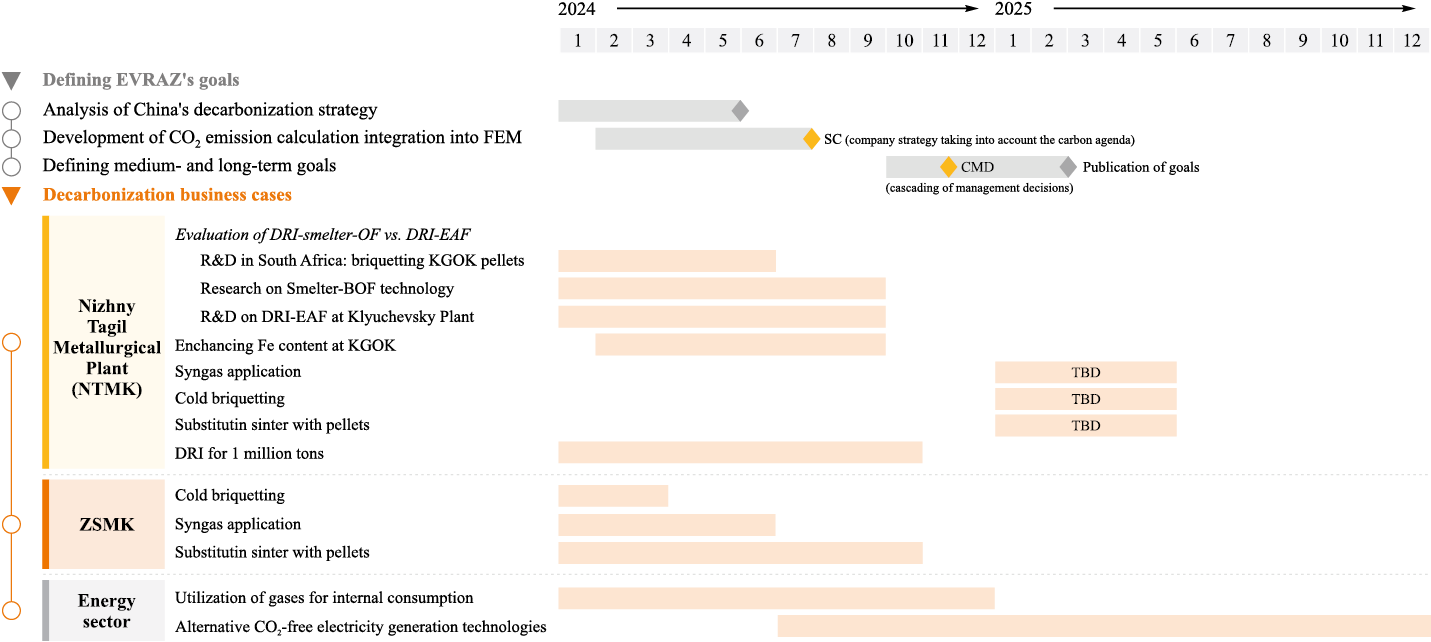

During the short-term phase, initiatives focus on CO2 emission reductions through energy efficiency projects. The program is planned for the next two years, followed by an annual emission reduction target of 1 %. A roadmap for decarbonization measures in the near future is presented in Fig. 1.

Fig. 1. Schedule for working out decarbonization measures for EVRAZ Group |

In the medium-term phase, initiatives aim to reduce CO2 content in “intermediate solutions”. A list of technologies is currently being evaluated for potential implementation at the Ural and Siberia divisions, including syngas utilization, cold briquetting, and replacing sintered ore with pellets.

For long-term sustainability, the most viable production model by 2050 is projected to be electric arc steelmaking combined with cold-briquetted iron (CBI) and direct reduced iron (DRI) production. The key considerations for these solutions include technological feasibility, investment volume, and operational costs.

At EVRAZ United West Siberian Metallurgical Plant (EVRAZ ZSMK), Russia’s first Green Rails pilot project has been implemented. The term “green rails” refers to products manufactured with four times lower CO2 emissions compared to traditional blast furnace-basic oxygen furnace steelmaking. The carbon intensity of the steel used for rail production is approximately 0.5 t CO2-eq. per ton. This reduction is achieved through electric steelmaking, renewable energy sources, and an optimized process with a higher proportion of steel scrap in the charge.

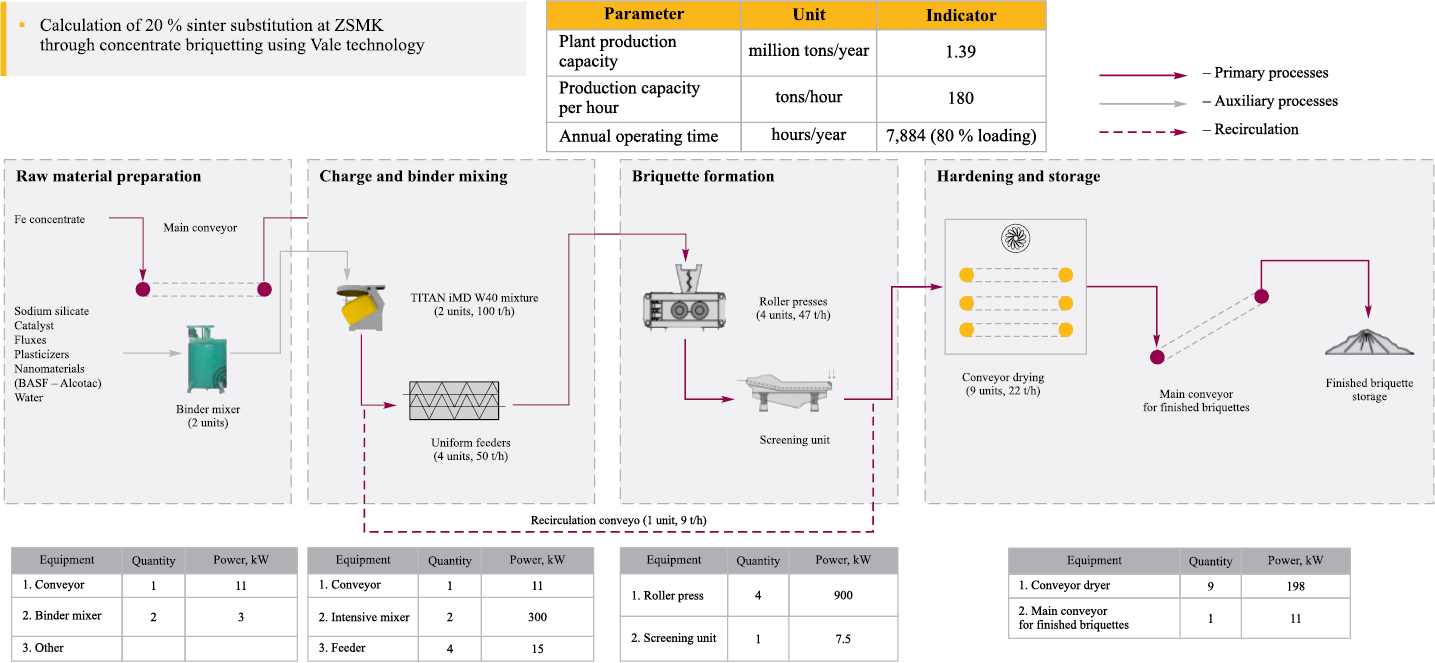

Research is underway to implement an innovative technology for reducing the carbon footprint using direct reduced iron (DRI). DRI is obtained by directly reducing iron ore (lumps, pellets, or fines) using a gas containing elemental carbon or hydrogen. Fig. 2 presents the technological process of cold briquetting.

Fig. 2. Diagram of technological process of cold briquetting |

The key advantages of DRI include: uniform chemical composition; low levels of harmful impurities; energy-efficient and environmentally friendly production; no seasonal dependence on raw material supplies; ease of transportation and use.

To enhance transparency and justify production-ecological decisions, EVRAZ Group calculates carbon intensity and carbon footprint for its products. This includes processing client requests for steel, vanadium, and coke-chemical products and developing methodologies for calculating supply chain emissions.

The company collaborates with the Russian Union of Industrialists and Entrepreneurs (RSPP) and the Russian Steel Association to mitigate carbon regulation risks and advocate for the ferrous metallurgy sector. An industry-wide benchmarking of CO2 emissions among association members was conducted to develop a unified methodology for assessing steel production’s carbon intensity. This initiative aims to establish a common industry stance on the potential risks of carbon pricing mechanisms.

Companies can assess their compliance with regulated entity status under Government Decree No. 355 of March 14, 2022, which defines criteria for classifying legal entities and individual entrepreneurs as regulated organizations. This assessment, based on Federal Law No. 296-FZ of July 2, 2021 (On Limiting Greenhouse Gas Emissions), is available on the State Information System for Energy Saving and Energy Efficiency Improvement. The CO2 emissions calculator for ferrous metallurgy enterprises includes indicators listed in Table 1.

Table 1. Indicators of production processes of ferrous metallurgy enterprises

|

The Siberia Division is currently implementing a greenhouse gas emissions automation project to facilitate mandatory reporting, particularly for the Carbon Border Adjustment Mechanism (CBAM). Additionally, efforts are underway to automate data collection for Scope 3 emissions calculations, including developing technical specifications and conducting investment evaluations.

The experience gained will later be applied to enterprises in the Ural region.

EVRAZ Group is committed to reducing its carbon footprint, integrating climate impact and sustainability considerations into its regularly updated documentation:

– Comprehensive Environmental Permit – from 2024, all reports must include greenhouse gas emissions data;

– mandatory government reporting – starting January 1, 2025, all enterprises with emissions exceeding 50,000 tons of CO2 must submit annual reports via the State Information System for Energy Efficiency);

– quarterly CBAM reports – detailing emissions from imported goods;

– annual corporate sustainability report.

Russian companies from various industries are actively developing climate projects. Examples of the largest projects by the volume of issued carbon units are listed in Table 2. Among all projects listed in the Russian Carbon Unit Registry, the metallurgical sector is represented only by business entities of the aluminum company RUSAL. There are no projects from ferrous metallurgy companies in the registry; however, carbon units (CUs) are available for metallurgical enterprises, with 80,824,742 CUs planned for issuance upon the completion of 31 climate projects.

Table 2. Indicators of production processes of ferrous metallurgy enterprises

|

Conclusions

The study identifies the following key directions for decarbonizing the ferrous metallurgy sector:

1. Operational decarbonization methods, including improvements in operational efficiency, enhanced energy efficiency in production processes, and reduction of indirect emissions from raw material and component manufacturing (Scope 3).

2. Transition to environmentally clean technologies, such as: DRI (Direct Reduced Iron – the reduction of iron ore or pellets using gases (СО, Н2 , NH3 ) and solid carbon; Green H2 DRI-EAF – the use of environmentally friendly hydrogen as a reducing agent for iron ore Carbon Capture, Use and Storage (CCUS) – technologies for capturing, storing, and utilizing carbon, among others.

3. Adoption of low-carbon energy sources, including natural gas, hydrogen, biofuels, and renewable resources.

4. Implementation of circular economy principles, such as the reuse and recycling of material and secondary energy resources, waste processing, and a shift toward secondary raw materials (scrap metal).

5. Optimization of total carbon intensity within asset portfolios, which may involve divesting carbon-intensive operations, establishing carbon farms, and acquiring carbon units.

When forming investment portfolios, companies should prioritize projects that have the potential to be classified as climate projects, provided they meet the additionality criteria.

The ongoing decarbonization processes in ferrous metallurgy contribute to increased energy efficiency, modernization of steel production in electric arc furnaces (EAFs), greater utilization of recycled metal, and advancements in hydrogen technologies and direct CO2 capture. The implementation of such projects drives the sustainable development of the metallurgical industry, enhances efficiency dynamics, and strengthens its niche in the competitive business environment.

References

1. Worldsteel Association, World Steel in Figures 2019. Brussels; 2019:30.

2. Donskoi E., Poliakov A., Manuel J.R. Automated optical image analysis of natural and sintered iron ore. In: Iron Ore. Woodhead Publishing; 2015:101–159. https://doi.org/10.1016/B978-1-78242-156-6.00004-6

3. Carpenter A. CO2 Abatement in the Iron and Steel Industry. IEA Clean Coal Cent; 2012;119.

4. Gleich A., Ayres R.U., Gossling-Reisemann S. Sustainable Metals Management: Securing Our Future-steps Towards a Closed Loop Economy 19. Springer Science & Business Media; 2007:395. https://doi.org/10.1007/1-4020-4539-5

5. IEA, Iron and Steel Technology Roadmap. Paris; 2020:187.

6. Industrial Decarbonisation and Energy Efficiency Roadmaps to 2050 – Iron and Steel. Montreal; 2015:106.

7. Crompton P., Lesourd J.-B. Economies of scale in global iron-making. Resources Policy. 2008;33(2):74–82. https://doi.org/10.1016/j.resourpol.2007.10.005

8. 2020 World Steel in Figures. Brussels: Worldsteel Association, 2020:30.

9. Xu W., Wan B., Zhu T., Shao M. CO2 emissions from China’s iron and steel industry. Journal of Cleaner Production. 2016;139:1504–1511. https://doi.org/10.1016/j.jclepro.2016.08.107

10. Jing R., Yasir M.W., Qian J., Zhang Z. Assessments of greenhouse gas (GHG) emissions from stainless steel production in China using two evaluation approaches. Environment Progress & Sustainable Energy. 2019;38(1):47–55. https://doi.org/10.1002/ep.13125

11. Kuramochi T. Assessment of midterm CO2 emissions reduction potential in the iron and steel industry: a case of Japan. Journal of Cleaner Production. 2016;132:81–97. https://doi.org/10.1016/j.jclepro.2015.02.055

12. Griffin P.W., Hammond G.P. Analysis of the potential for energy demand and carbon emissions reduction in the iron and steel sector. Energy Procedia. 2019;158:3915–3922. https://doi.org/10.1016/j.egypro.2019.01.852

13. Griffin P.W., Hammond G.P. Industrial energy use and carbon emissions reduction in the iron and steel sector: A UK perspective. Applied Energy. 2019;249:109–125. https://doi.org/10.1016/j.apenergy.2019.04.148

14. Juntueng S., Towprayoon S., Chiarakorn S. Energy and carbon dioxide intensity of Thailand’s steel industry and greenhouse gas emission projection toward the year 2050. Resources, Conservation and Recycling. 2014;87:46–56. https://doi.org/10.1016/j.resconrec.2014.03.014

15. Larsson M., Dahl J. Reduction of the specific energy use in an integrated steel plant ‒ The effect of an optimisation model. ISIJ International. 2003;43(10):1664–1673. https://doi.org/10.2355/isijinternational.43.1664

16. Wang Ch., Ryman Ch., Dahl J. Potential CO2 emission reduction for BF – BOF steelmaking based on optimised use of ferrous burden materials. International Journal of Greenhouse Gas Control. 2009;3(1):29‒38. https://doi.org/10.1016/j.ijggc.2008.06.005

17. Glushakova O.V., Chernikova O.P. Institutionalization of ESG principles at the international level and in the Russian Federation, their impact on the activities of ferrous metallurgy enterprises. Part 1. Izvestiya. Ferrous Metallurgy. 2023;66(2):253‒264. (In Russ.). https://doi.org/10.17073/0368-0797-2023-2-253-264

18. Butorina I.V., Butorina M.V., Vlasov A.A., Semencha A.V. Assessment of the possibility of ferrous metallurgy decarbonization. Chernye metally. 2022;(3):71‒77. (In Russ.). https://doi.org/10.17580/chm.2022.03.13

19. Klimenko A.V., Tereshin A.G., Prun O.E. Ways to reduce greenhouse gas emissions in the ferrous metallurgy of Russia. Promyshlennaya energetika. 2023;(9):8‒19. (In Russ.). https://doi.org/10.34831/EP.2023.67.59.002

20. Chernikova O.P., Zlatitskaya Yu.A. Resource efficiency of metallurgical production. Izvestiya. Ferrous Metallurgy. 2022;65(6):390‒398. (In Russ.). https://doi.org/10.17073/0368-0797-2022-6-390-398

21. Glushchenko A.M. Decarbonization of the steel industry: The role of state economic policy. The Problems of Economy. 2020;(1(43)):340‒347. https://doi.org/10.32983/2222-0712-2020-1-340-347

22. Yoon Y., Kim Y.-K., Kim J. Embodied CO2 emission changes in manufacturing trade: Structural decomposition analysis of China, Japan, and Korea. Atmosphere. 2020;11(6):597. https://doi.org/10.3390/atmos11060597

23. The strategy for the development of the metallurgical industry of the Russian Federation for the period up to 2030, approved by Decree of the Government of the Russian Federation No. 4260-r dated December 28, 2022.

24. Skelton A.C.H., Allwood J.M. The incentives for supply chain collaboration to improve material efficiency in the use of steel: An analysis using input output techniques. Ecological Economics. 2013;89:33–42. https://doi.org/10.1016/j.ecolecon.2013.01.021

About the Authors

O. P. ChernikovaRussian Federation

Oksana P. Chernikova, Cand. Sci. (Economics), Assist. Prof., Head of the Chair of Economics, Accounting and Finance

42 Kirova Str., Novokuznetsk, Kemerovo Region – Kuzbass 654007, Russian Federation

O. V. Afanas’eva

Russian Federation

Ol’ga V. Afanas’eva, MA Student

42 Kirova Str., Novokuznetsk, Kemerovo Region – Kuzbass 654007, Russian Federation

E. G. Afanas’ev

Russian Federation

Evgenii G. Afanas’ev, MA Student

42 Kirova Str., Novokuznetsk, Kemerovo Region – Kuzbass 654007, Russian Federation

Review

For citations:

Chernikova O.P., Afanas’eva O.V., Afanas’ev E.G. Directions of decarbonization of Russian ferrous metallurgy. Izvestiya. Ferrous Metallurgy. 2025;68(1):90-97. https://doi.org/10.17073/0368-0797-2025-1-90-97